Find Better Camper Conversion Insurance

At campervaninsurance.co.uk we want to try and help our community find and compare camper conversion insurance quotes quickly and easily to save time and money. By completing the quote form on our website you can receive quotes from multiple specialist camper van insurers. Hopefully you will find a great policy and deal!

Why You Could Need Specialist Camper Conversion Insurance

If your camper van was previously classified as a van in the UK then you will require specialist campervan conversion insurance for your vehicle. This is because standard campervan insurance is typically designed for manufacturer built campervans.

Some people buy a ready-made campervan, with a standard layout made by a manufacturer. Others choose to convert a van into a campervan themselves or work with a campervan conversions company.

Reasons Why Insurers View Conversions Differently

Some people buy a ready-made campervan, with a standard layout. Others choose campervan conversion so that they can personalise their campervan and fit it out with the extra options and layout that is best for them.

You might have converted a campervan yourself, or paid for professional campervan conversion from a specialist company. Whatever your situation, it’s incredibly important to get the right insurance for your convert van and make sure that your investment is protected.

Cost of Campervan Conversion Insurance

With a converted campervan, it’s very important that your vehicle is properly valued. Your insurer should agree with the valuation provided by you or the professionals you hired to complete the conversion. If the vehicle is later damaged, you want to make sure that you get back the right amount of money.

Each campervan conversion is unique. Whether you’ve bought a campervan that’s already converted, or you’ve asked for one that’s made to your requirements, your vehicle’s a one-of-a-kind moving home that needs an individual assessment.

After your vehicle has been assigned a value, your quote will tell you how much you’ll pay for your cover. Campervan conversion insurance typically costs anywhere from £200 to £1,000. In rare cases, the price may be higher or lower.

The cost of your campervan insurance will depend on several different factors. These include:

- Your age

- Your driving experience

- Any previous driving convictions

- The vehicle make, model and age

- The fixtures and fittings of your campervan

- Security features

- Usage habits and storage

Getting Campervan Conversion Insurance

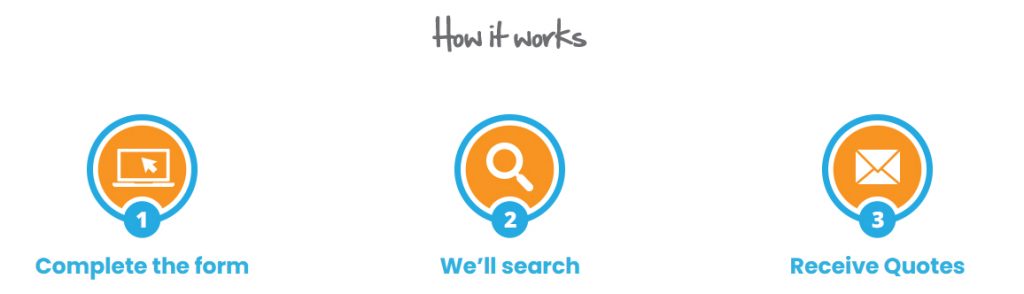

The first step to getting the right insurance cover is to fill in our form. Provide basic details and essential facts about your campervan conversion. We’ll send your details to several insurers, getting responses from those that are happy to insure you. We help you save time, because you won’t need to send several applications or quote forms on your own.

With campervan conversions, the insurance quote process does get a little more complicated. You and your insurer need to agree on the value of your campervan, which will be different for every conversion as each vehicle has different fittings.

Once you’re happy and you and your insurer agree how much your vehicle’s worth, you can get a final quote.

The Converted Campervan Insurance Quote Process

With a campervan conversion, it’s very important to get an accurate quote. Any errors at the start could make your insurance null and void if you ever need to claim.

As part of the process of getting a quote, your insurer might ask for photographs and details about what’s included in your campervan. Try to be honest and thorough, so you can be sure that your insurance is valid when you’ve finalised your payment.

If you need assistance, and opted for professional campervan conversion, then the company you used should be able to provide you with any technical details.

Maintaining Campervan Conversion Insurance Policy

Insurers understand that fine-tuning a conversion often happens at a later date. What you think you’ll need, when you’re converting your van, might not be what you actually use.

There’s nothing wrong with adjusting your campervan once you’ve signed up for insurance, but it is important to tell your insurer if you’ve made any changes. Even small adjustments might need to be reflected within your insurance policy, and may change the price of your insurance. Your insurance costs won’t always go up, but keeping your insurer up to date means that you’re always properly covered.

Anything you change within your campervan might affect the value of your vehicle. Don’t forget to keep an accurate record of everything you’ve got in your campervan.

Get Your Campervan Conversion Insurance Quotes

Your campervan conversion is yours to enjoy in the years and decades ahead. The right insurance offers peace of mind, so you can enjoy every holiday or trip to the seaside.

After your campervan conversion is complete, it’s important to make sure that the vehicle’s changes are properly recorded in the log book. Send evidence to the DVLA, so they can assess your campervan conversion and change your vehicle’s body type.

When your V5C document accurately reflects the type of vehicle you’re driving, fill in our online insurance quote form and let us take care of the next steps. We’ll put you in touch with suitable insurers, able to offer campervan conversion insurance that’s suited to your vehicle.

To find out more about how we can help you find the right campervan insurance please visit our dedicated page. If you would like to get a quote from several specialists then please click on the banner below.

A Guide to Campervan Conversion

Campervan conversions come in many forms. Usually, conversions are personalised to meet the unique requirements of their owners. You might have used a vehicle such as an MPV, minibus or van, and may have chosen to tackle the project of a self build conversion. Alternatively, you could have bought your campervan from someone that’s converted it already.

Popular vehicles for campervan conversions include:

- Larger cars, MPVs and mobility vehicles (like the Renault Kangoo, Ford Galaxy or Toyota Previa)

- Vans (like the Volkswagen Transporter, Ford Transit or Renault Trafic)

- Specialist vehicles (like an ambulance, minibus or livestock carrier)

If you'd like to discover more, then check out our blog post to discover the best van for a campervan conversion .

Some companies offer campervan conversion services. They’ll sell campervans they’ve already finished, or you can buy any suitable vehicle and provide a list of requirements. Companies can work to your specifications, designing and creating the campervan that you’ve always wanted.

A campervan conversion means that you can get a vehicle that’s tailored to your needs. Converted campervans can fit your lifestyle, whether you use them just a few times a year or drive them as your everyday vehicle.

Professional Campervan Conversion

If you want to tackle your own campervan conversion, it’s best to learn more about self build campervan insurance. There are many different things to consider, whether you choose to go it alone or get help from a professional company.

If you’re paying for a professional service, you’ll also need the right cover your converted vehicle.

A professional campervan conversion might include the fitting of:

- Interior furniture to your specifications

- Custom soft furnishings, curtains or blinds

- Lighting

- Windows and additional doors

- Fixed electricals like TVs and satellite dishes

- Plumbing and wiring

Once your campervan conversion is complete, you may need to have the body type changed on your log book (V5C document). This will change your vehicle’s legal type from a van (or other vehicle) to a ‘motor caravan’. After you’ve completed this process, then you’ll be able to buy specialist insurance for your converted campervan van.

Read our Guide to help you compare campervan insurance in the UK like an expert, so that you can get the best quotes for your needs and potentially reduce your annual insurance costs.